Information for Submitting Tax Returns & Refunds

Bankruptcy laws require that all Chapter 13 debtors submit their tax returns each year they are in bankruptcy. In addition, tax refunds are also required to be sent to the Trustee.

In order to determine how much of your refund needs to be submitted to the Trustee, please either consult your attorney or refer to your copy of the Order Confirming Chapter 13 Plan.

DO NOT mail or email copies of tax returns to our office.

Copies of tax returns MUST be uploaded to our secured portal at www.bkdocs.us

- Debtors may submit their tax refund via cashier's check, certified check, money order, or online. The Trustee's office does NOT accept personal checks. Please follow the instructions below for submitting tax refunds.

Cashier's Check/Money Order

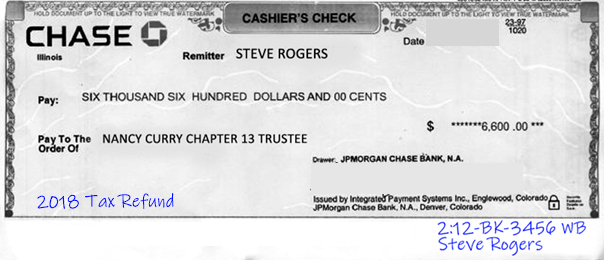

- 1. All cashier's checks or money orders must be made out to: "Nancy Curry Chapter 13 Trustee." Checks and money orders made out to "Bankruptcy Trustee" or anything other than "Nancy Curry Chapter 13 Trustee" WILL NOT be accepted.

- 2. The debtor's name and bankruptcy case number must be listed on the payment. Failure to do so will result in the payment being returned. Also, please indicate that the payment is a tax refund.

- Below is an example of how to properly make out the refund:

- 3. Tax refunds sent to the Trustee's office in Los Angeles will not be accepted. Tax refunds must be sent to the following address:

Nancy Curry Chapter 13 Trustee

PO BOX 1403

Memphis, TN 38101Online via TFS Billpay

- Debtors may submit their tax refund online via TFS BillPay. In order to do so, registration is required, though registration is free. If you already have an account with TFS, simply log into you account.

- When submitting your payment, please be sure to select "Tax Refund" as the payment type. If you do not select this option, we will not be able to determine whether or not the payment is a tax refund.

- If you forget to select the "Tax Refund" payment type and you've already submitted your refund, please contact our office here.